Starting Your FreeScoresAndMore Trial is as Easy as 1-2-3!

Get your 3 FREE Credit Scores as of Apr 26, 2024

Important Information: Begin your membership in FreeScoresAndMore for 14 days and check your scores for free. If you don't cancel within the 14-day trial period, you will be billed $19.99 per month until you cancel your membership.

CLICK.

Click on "Click Here to Start."

COMPLETE.

Fill out the simple form.

VIEW.

Confirm your identity & see your scores.

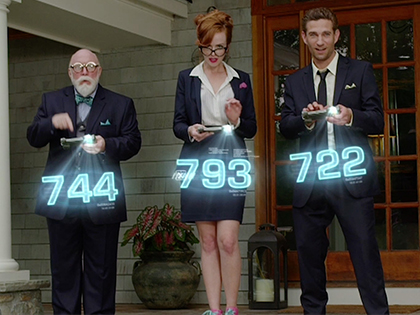

FreeScoresAndMore helps protect you with the Power of 3!

1

Credit Scores:

What You Need to Know

See all 3 scores today free - Experian, Equifax, and TransUnion. Your VantageScore credit score are provided by VantageScore Solutions LLC Although these scores are not used by lenders to evaluate your credit, they are intended to reflect common credit scoring practices and are designed to help you understand your credit.

2

Credit Monitoring & Alerts

Help protect your credit and personal information with daily credit monitoring1 of your files at the three major credit reporting bureaus - Experian, TransUnion and Equifax. Plus, receive quick alerts by text, email or phone when certain changes occur in your credit files. Changes you may not be aware of, that can indicate potential credit or identity fraud.

3

Identity Theft Protection

Identity Verification Monitoring works in real-time to help prevent your personal data from being used for fraudulent activities that may result in identity theft, account takeovers, or account compromises. In the event your identity becomes compromised, you can count on the support and guidance of our experienced fraud recovery experts to help you resolve key issues.

Start your FREE Trial and get all this!

- Access To Your 3 Credit Scores

- Daily 3-Bureau Credit Monitoring

- Alerts Of New Accounts, Credit Inquiries And More

- Identity Fraud Support Service

- Online Credit Education Center

Use the Credit Score Simulator